Winter gas load shedding in Pakistan now routine, straining industrial

According to how things have changed thus far, these winters may not necessarily be considerably harsher in terms of gas load shedding. There is a lot in the dark in terms of LNG Gas supply come the three months starting December.

Qatar and China signing the biggest LNG agreement in history, the market won’t be very active until at least 2026. Market watchers, there won’t be any new supply contracts on the LNG long-term contract market for at least three more years. The ships around the western coasts are gradually getting their opportunity to unload. All things considered, even though winter is harder than previous, Europe has generally secured a sufficient supply.

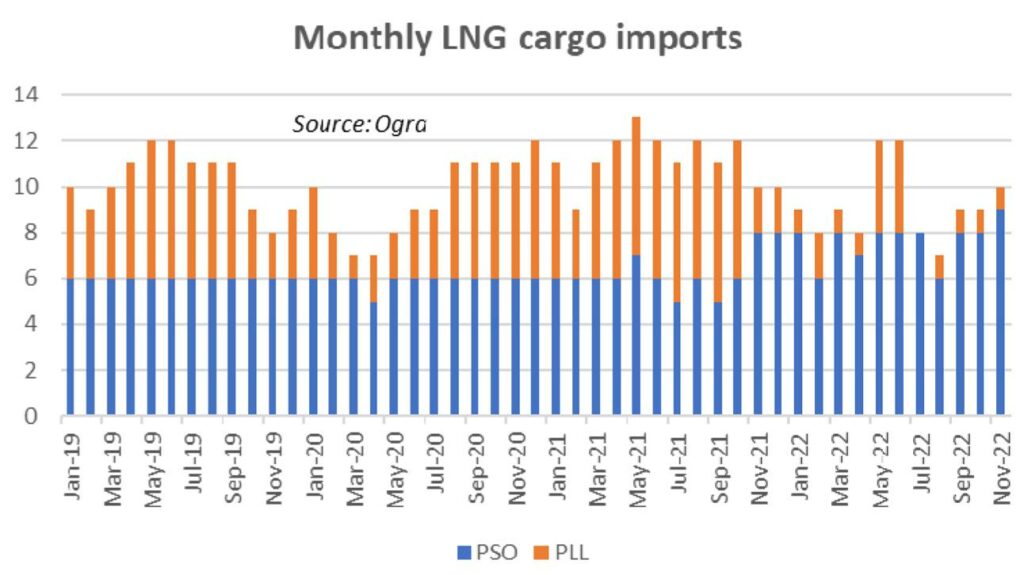

LNG Gas Supply Cargo Imports

The LNG market will enter a bear market since Europe continues to be the preferred destination and because the differential between East and West has grown as a result of Europe‘s daily decline in Russian imports. Given that the spot market will account for the majority of price variation, the near certainty surrounding long-term contracts does indicate price stability.

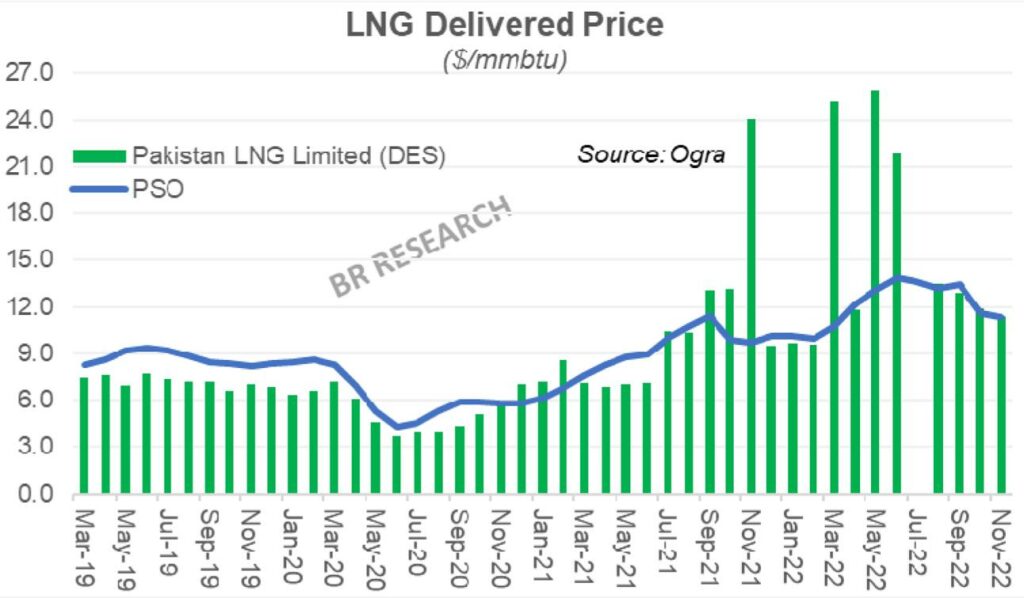

Pakistan continued to handle 10 LNG cargoes during the November price determination reference period. The composition has altered since Pakistan hasn’t had any takers for its invites to bids from the spot market in a while. The import of LNG is nearly fully supported by long-term agreements with several partners at varied rates. Contrary to the previous year, there have not been many last-minute cancellations of cargo on the spot market.

But since Pakistan relies mostly on supply from state-owned contracts, which have a better track record of being honored, there isn’t much to be canceled. Since the Slope is based on the trailing three-month Brent oil price average, lower Brent prices will be helpful.

The average consumer RLNG price, excluding GST, for November has been calculated to be roughly $14/MMBtu; it has been steadily declining since June 2022 and has been a fairly constant month over month.

Nearly half of the long-term contractual supply is now covered by PSO contracts at 10.2% of Brent, substantially reducing the average Delivered Ex-Ship Price. The administration has not indicated that it would change its policy of prioritizing the local market.

Nevertheless, despite explicit agreements with the IMF, a decision about weighted average gas prices is still waiting. Remember how the government decided to increase consumer gas prices by more than what the authorities had set? Gas prices may have peaked, but supply will still fall short of the demand for the season.