What’s life insurance, how it works and how do you purchase a policy?

A life insurance policy is a legal agreement between a policy holder and a insurance company. In return for premiums paid by the policyholder during their lifetime, insurance policy promises the insurer will pay a certain amount to one or more named beneficiaries after the covered person passes away.

- Term life insurance plans have a certain number of years before they expire. Permanent life insurance policies are in effect until the insured passes away, the premiums are stopped, or the policy is surrendered.

- The face value, or death benefit, of the policy will be paid to the designated beneficiaries upon the death of the insured.

- A policy is only as good as the firm that issues it in terms of financial stability. If the issuer is unable to pay claims, state guarantee funds may.

- Life insurance is a binding agreement that provides the policyholder with a death payout in the event.

Permanent vs Term:

Although term and permanent have several key differences, most customers looking for low-cost life insurance coverage find that term best suits their needs. Term life insurance is limited in duration and provides a death benefit in the event that the policyholder passes away before the term has ended.

As long as the policyholder continues to make premium payments, permanent life insurance is still in effect. A significant premium differential between term and permanent life is also present, as there is no need to accumulate capital value, term life is typically much less expensive.

The amount of money needed to sustain your dependent level of living or fulfil the requirement for which you are acquiring a policy should be determined before you apply for life insurance. Also take into account how long you will require coverage.

If you are the primary career and your children are 2 and 4 years old, for instance, you would need adequate insurance to cover your custodial responsibilities until your children are old enough to support themselves.

If you want to add money for education, you can examine the cost of hiring a nanny and a housekeeper or employing commercial child care and cleaning services. In your life insurance estimate, take into account your spouse’s retirement needs as well as any outstanding mortgages.

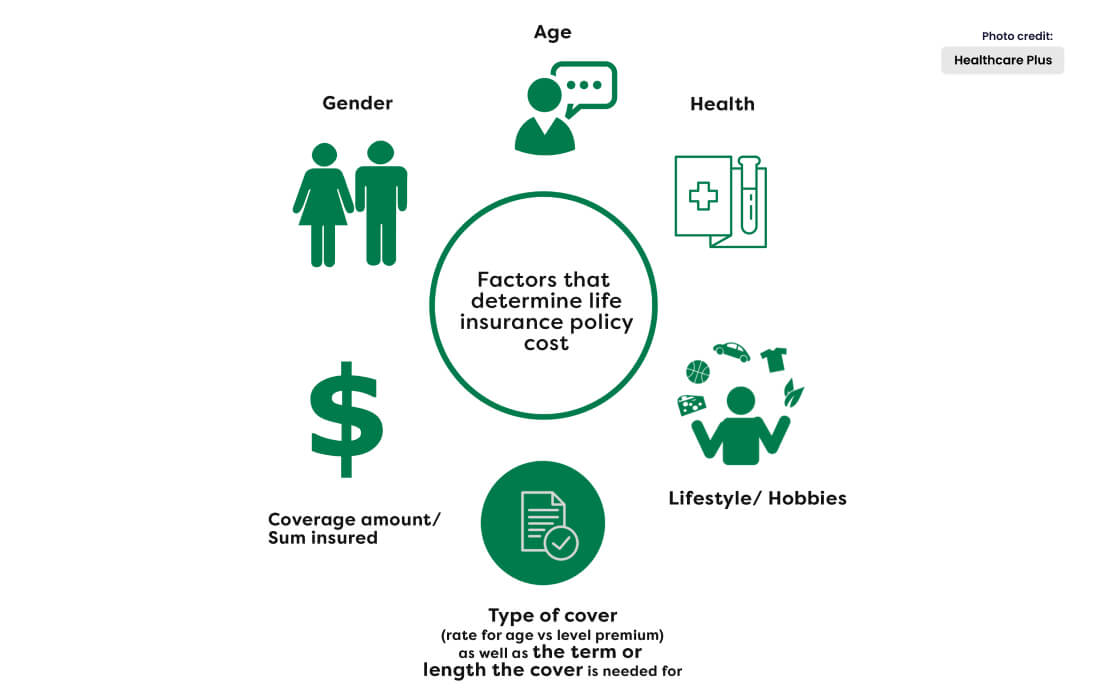

What Determines the Premiums and Costs of Your Life Insurance?

The price of life insurance premiums might vary depending on a variety of factors. While some circumstances may be beyond your control, you might potentially reduce the cost before (and even after) applying by controlling other requirements.

The best plan of action is frequently to purchase life insurance as soon as you need it because your age and health are the two main elements that affect pricing.

If your health has improved and you’ve adopted a healthier lifestyle after receiving insurance policy approval, you can ask to have your risk category changed.

Your rates won’t increase even if it turns out that your health is worse than it was at the time of the original underwriting. Your premiums can go down if your health is determined to be improved. Additionally, you might be able to purchase more coverage for a lesser price than you originally paid.

Guide to Buying Life Insurance:

Step 1: Determine How Much You Need:

Consider what costs would need to be paid in the event of your passing. Mortgage, college costs, and other bills, not to mention burial costs, are just a few examples. If your spouse or other family members depend on you for financial support but are unable to do it on their own, income replacement is a crucial consideration.

Step 2: Get Your Application Ready:

Applications for life insurance typically ask for beneficiary information as well as personal and family medical history. You might be required to have a medical examination, and you’ll have to be honest about any past health issues, histories of moving offences and DUIs, and any risky pastimes like skydiving or motor racing.

The following components are essential to the majority of life insurance applications:

Health: The majority of insurance policies include annual physicals that include risk factor screenings for diseases including cancer, diabetes, and heart disease as well as other medical disorders.

Gender: Women typically pay lower rates than men their age because they statistically live longer.

Smoking: Smokers run the risk of developing a number of illnesses that could shorten their lives and raise their risk-based insurance costs.

Age: The highest risk factor for the insurance firm is life expectancy, making it the most significant component.

Driving record: The price of insurance premiums might rise significantly if a driver has a history of moving offences or drunk driving.

Family medical history: Your chance of contracting some diseases is significantly increased if there is a history of serious illness in your close family.

Lifestyle: Risky behaviors can significantly increase premium costs.

Before a policy can be created, standard kinds of identification like your Social Security card, driver’s license, or U.S. passport will also be required.

Step 3: Compare Policy Quotes:

Once you have gathered all the data you require, you may use your research to compare many life insurance rates from various companies. It’s crucial to make the effort to obtain the finest insurance for your needs in terms of policy, company reputation, and premium cost because prices can vary significantly from one company to another.

Finding the ideal coverage for your needs might save you a ton of money because life insurance is probably something you will pay monthly for decades.

Advantages:

The advantages of getting are numerous. The most significant benefits and safeguards provided by life insurance policies are listed below.

Most people buy life insurance to give money to beneficiaries who would be financially disadvantaged in the event of the insured passing. The tax benefits of life insurance, such as the tax-deferred growth of cash value, tax-free dividends, and tax-free death payments, might, however, present extra strategic opportunities for wealthy people.

Avoiding Taxes:

A death benefit is typically tax-free. Rich people occasionally get permanent life insurance within a trust to cover estate taxes. This tactic aids in maintaining the estate worth for the benefit of the heirs.

Tax evasion, which is unlawful, should not be confused with tax avoidance. Which is a lawful method of reducing one tax obligation.