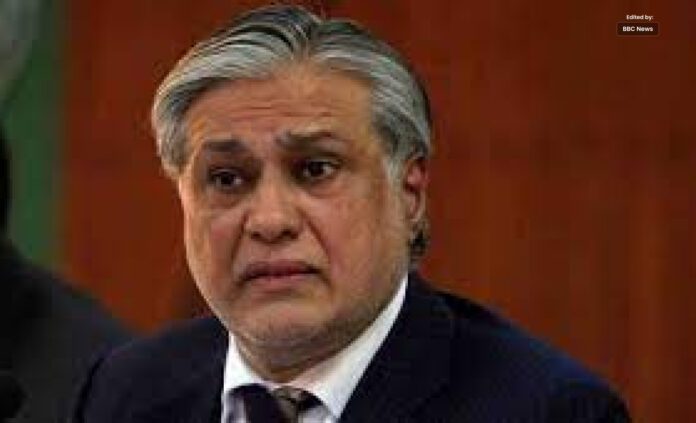

Finance Minister Ishaq Dar: Country Nearing IMF Staff Level Agreement.

This is happen to address a balance of payment crisis, the agreement is expect to release $1.1 billion to Pakistan struggling economy.

Pakistan’s Finance Minister, Ishaq Dar, announced on Thursday that the country was “very close” to signing a staff level agreement with the International Monetary Fund (IMF).

The agreement, which is expected to offer a critical lifeline to Pakistan’s struggling economy, would release $1.1 billion to help tackle a balance of payment crisis.

Dar made the announcement at a seminar in Islamabad, stating that his team was commit to completing the program to the best of their ability.

The IMF mission has been negotiating with Pakistan since early February to finalize the deal, which includes policy measures to manage the fiscal deficit ahead of the annual budget due in June.

The funds are part of a $6.5 billion bailout package approve by the IMF in 2019, which analysts say is crucial if Pakistan is to avoid defaulting on external debt obligations.

Dar believes that the current crisis is deeper and more complex than the two prior experiences he had oversee as finance minister, but he remains confident that the economy will be pull out of the “quagmire”.

Reforms in the energy sector, which has accumulate more than four trillion rupees ($14.18 billion) in debt, are deem critical to get the economy back on track, according to Dar.

An IMF deal would unlock other bilateral and multilateral financing avenues for Pakistan to shore up its foreign exchange reserves, which have fallen to just four weeks’ worth of import cover.

Pakistan has meet most of the IMF’s demands to clear the review, with the last one yet to be fulfill on the list being an assurance on external financing to fund its balance of payment gap for the current fiscal year, ending on June 30.

China is the only country that has announced refinancing of a $2 billion loan, and Pakistan’s central bank has already received $1.2 billion of that amount.

Pakistan had to complete a series of prior actions demanded by the IMF, including reversing subsidies in the power, export, and farming sectors.

A hike in energy and fuel prices, a permanent power surcharge, jacking up the key policy rate, a market-based exchange rate, and raising over 170 billion rupee($613.17 million) in new taxation through a supplementary budget.

The rupee has depreciated by 1.19% against the US dollar in inter-bank trading in Thursday’s opening session, but it has recovered almost half of its losses by afternoon.

It has lost around 20% of its value so far this year, extending a near 30% drop in 2022. The fiscal adjustments have already fueled 50-year record high inflation, which hit 31.5% year-on-year in February.

Despite the challenges, Dar believes that Pakistan can control the current inflationary pressures.

“I believe that we have to work together to control the current inflationary pressures,” he said, adding, “they’re unprecedented.”