Pre-market trading occurs from 8 to 9:30 am, preceding market session.

Only through a “electronic market” like an alternative trading system (ATS) or electronic communication network (ECN) can pre-market trading be done with a limited number of orders. Orders placed by market makers cannot be fulfilled before the opening bell at 9:30 a.m. EST.

Knowledge of Pre-Market Trading:

Due to the relatively low volume and liquidity of pre-market trading, wide bid-ask spreads are typical.

Although many retail brokers provide pre-market trading, they could have restrictions on the kinds of orders that can be placed at this time.

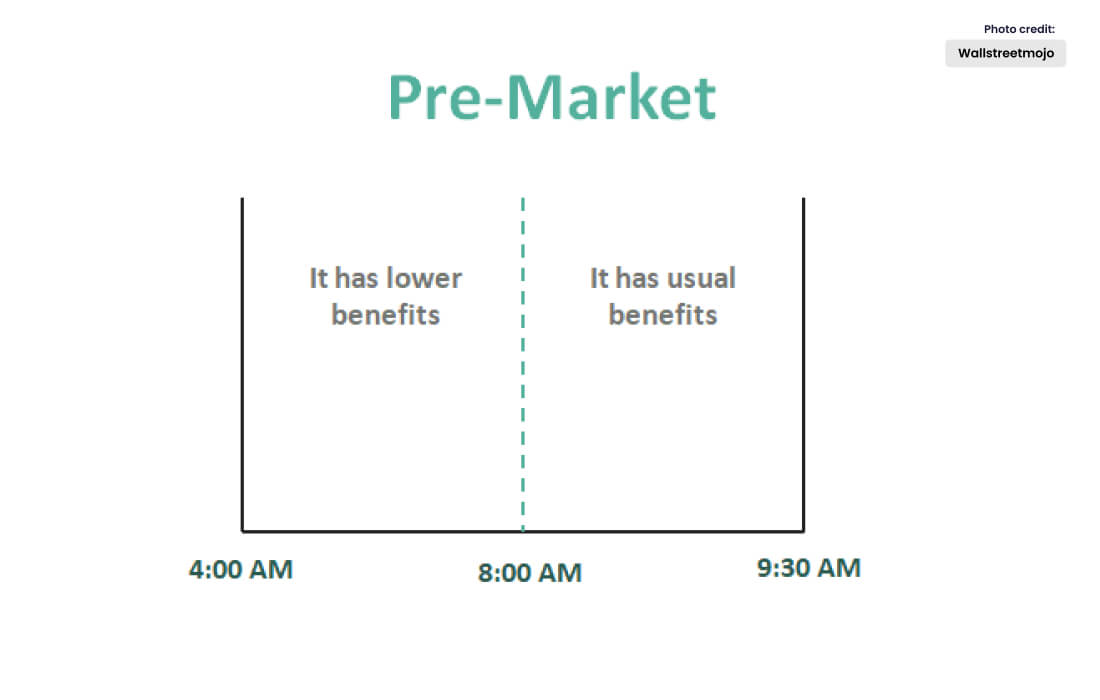

On Monday through Friday, trading can start as early as 4 a.m. EST with a few direct-access brokers.

- Trading that takes place between 4 a.m. and 9:30 a.m. EST is known as pre-market trading.

- Thin liquidity, small trade volumes, and wide bid-ask spreads define pre-market trading.

Benefits:

Extended hours trading, which includes both pre-market and after-hours trading, has similar advantages and dangers. Let’s start by examining the advantages:

- Get a head start on opposition: Smart investors and traders with experience in after-hours trading may use the market to purchase or sell stocks at prices that are more advantageous than those attained by other traders during the normal session. This is only conceivable if the stock does not fully discount the news in this trading and the pre-market reaction to news about the stock is accurate.

- Gives the chance to respond quickly to overnight news: Retail investors get the chance to respond to overnight news during pre-market trading before the main trading day starts. A large company announcement, corporate earnings (although most companies release earnings after markets close rather than before the open), overnight breaking news like a geopolitical development, or news from international markets could all qualify as such information.

- Satisfaction: Not everyone has a schedule that allows trading during regular market hours, so this is a huge advantage for the do-it-yourself investor. Due to the hectic pace of daily life, most individuals find it to be a huge advantage to be able to start the day early and execute trades in the pre-market.

Risks:

The dangers include the following:

- Price confusion: Prices of equities traded before the market open may differ dramatically from those prices during regular trading hours. Stock prices may only represent prices from one or a small number of electronic communication networks (ECNs), in addition to the effect that significantly different trading volumes and regular sessions have on stock prices.

- Limit orders may not be carried out: In order protect investors from unforeseen adverse price changes, several brokerages only accept limit orders during prolonged trading hours. Only the limit price or a better price can be used to fulfil limit orders. The advantage of this limit order feature is that it informs the investor of the highest and lowest prices at which a stock will be purchased or sold.

- Wide bid-ask spreads and limited liquidity: Pre-market trading has a far smaller number of stock buyers and sellers than normal trading, which attracts a much larger number of traders and investors. As a result, volume often represents a small portion of regular session volume.

- Competitors with institutional traders: Because many of the participants in this trading are institutional and professional traders, who have an advantage in trading due to considerably bigger wallets and access to better, more up-to-date information, retail traders confront an unequal playing field.