Remortgaging swaps lenders, replaces the current mortgage with loan.

Remortgage might be a good idea if you’re:

- Expiration of your current mortgage rate

- Seeking a better deal than what your current lender is willing to provide

- Preparing to take out a new loan against your property

What is the process of remortgage?

The essential steps for remortgage are as follows:

Consider the costs of remortgage

It’s crucial to know if switching your mortgage to a different lender is financially advantageous because there can be expenses involved.

You can estimate your new mortgage payments to better grasp the situation and determine whether remortgaging is advantageous overall.

These expenses may consist of:

- Costs for booking or completion imposed by a new lender

- Moving expenses

- Cost of property valuation

- Early repayment penalties (ERP) or termination fees assessed by your present lender

Apply for your remortgage

You can submit an application for your new mortgage if the Decision in Principle meets your needs. You can do this over the phone, in a branch, or online.

A hard credit check will be performed on your new application, and you will also be required to submit a number of supporting documents to attest to your income and other information. Documentation for your present mortgage and homeowners insurance will be part of this.

Review your offer

Your property will need to be valued by your new lender in order to ensure that it will serve as security for the new loan you are proposing.

Your lender will give you an offer for evaluation and acceptance once this is finished and your application has been approved.

Do your research

To get the best mortgage arrangement for you, it can be helpful to compare the available options. Before going elsewhere, do this by asking your present lender what rates they can provide and whether you can move to a new mortgage rate with them.

To assist you decide if it’s the correct moment to remortgage and the current mortgage rates, keep in mind that advice and support are accessible.

Get a Decision in Principle

A Decision in Principle, sometimes referred to as an Agreement in Principle, provides you with a precise estimate of the maximum amount you could borrow in light of your specific situation.

Receiving a Decision in Principle does not bind you and does not ensure that your mortgage application will be approved. There will be no effect on your credit score and it entails a mild credit check to look at your credit history.

Complete the legal work

Remortgage does require some legal effort even though you are not purchasing a new house. You might be allowed to choose your own conveyancer or lawyer, but some lenders will choose one on your behalf.

On your behalf, a lawyer or licensed conveyancer will handle the paperwork and any money transfers. They will make sure your new loan amount is sufficient to pay off your current lender before sending you the legal paperwork to review and accept.

Final step

You are prepared for completion once the legal process has been completed and your new mortgage has been set up.

The start of your new mortgage and the repayment of your previous one is known as the completion date.

The date and sum of your first new mortgage payment will then be communicated to you in writing by your new lender.

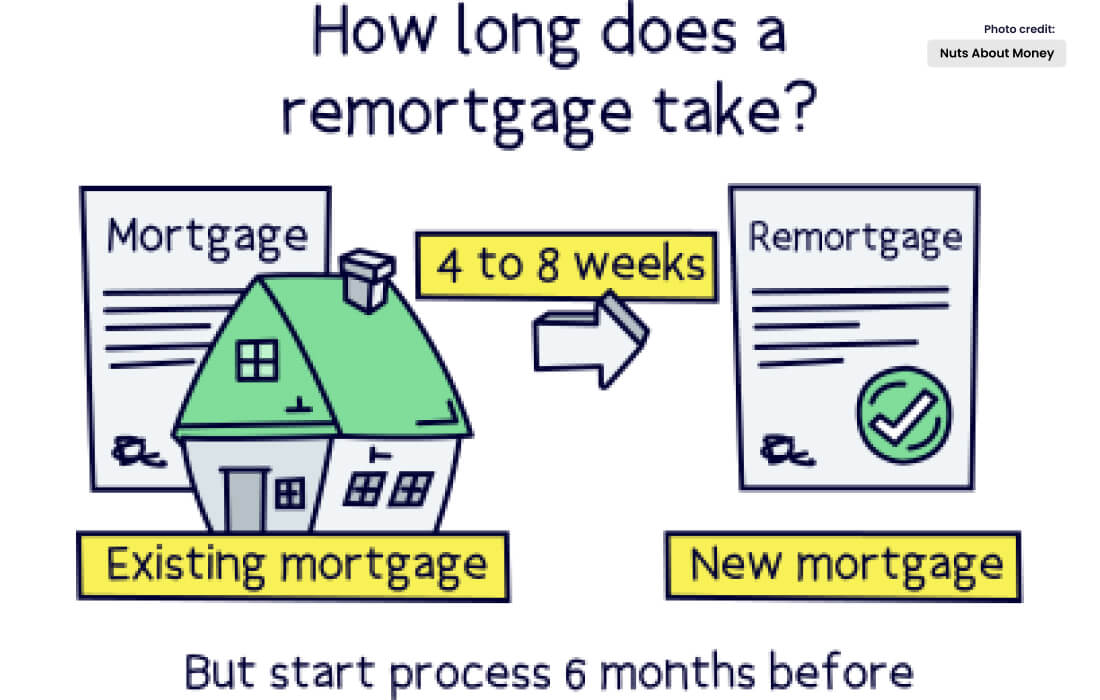

How long does it take to remortgage?

After applying, it usually takes 4 to 8 weeks to remortgage your house. The length of time required will vary depending on your unique situation and remortgage requirements.

When necessary, providing precise, complete, and pertinent documentation, such as proof of income, can hasten the procedure.

When should you remortgage?

You can remortgage at any time, but most people choose to do it near the end of their current mortgage rate to avoid any early repayment fees.

If you decide not to review your mortgage rate before it expires, your lender will likely switch you to their standard variable rate (SVR), which could result in higher payments. The SVR is often greater than the rate you were on, which is why.

Keep in mind that if your current mortgage rate is not about to expire, you should find out whether there is a fee or charge for paying off your current loan early.