Travel insurance is based on affordability of your potential losses.

Travel insurance offers financial security, which is often the wisest response.

You may evaluate whether to purchase travel insurance in the best way possible by being aware of what it is and what it protects.

What is Travel Insurance?

The aim of travel insurance is to provide protection from potential risks and financial losses.

The dangers might vary from little annoyances like missed connectivity information and delayed luggage to more serious problems like serious accidents or diseases.

What is insured by travel insurance?

Depending on the plan you pick, travel insurance can offer coverage for a wide range of potential losses and damages:

Injury or sickness:

Since your regular health insurance does not include coverage for medical costs overseas, travel insurance can help.

The plurality of health insurance plans don’t provide full coverage abroad, and others, like Medicare, don’t give any coverage at all.

Travel insurance, in supplementary to your usual health insurance, can assist in covering the costs of your medical care if you get sick or harmed before or during your trip.

Misplaced luggage:

Travel insurance could pay a portion of the costs related to lost or stolen luggage.

This is especially beneficial if they misplace your bags because it can be quite difficult to get an airline to reimburse for missing luggage.

The US Department of Transportation (DOT) requires airlines to compensate travellers for lost or stolen luggage up to $3,300.

There is a $1,750 cap on that amount in other nations

For such maximum reimbursements, passengers must provide receipts alluding to the value of the stolen bags and their belongings.

Additionally, several airlines demand that claims be submitted within 21 days.

The fact that the DOT doesn’t identify when luggage is actually lost makes the situation worse (as opposed to just “delayed”). Only after 21 days is a bag considered “lost” when travelling abroad.

Airlines are only required by the DOT to give victims of delayed bags enough money to purchase basic items like clothing, medicine, and toiletries.

Sudden cancellations:

Insurance coverage may help to cover expenses involved with trip cancellations.

The mass of hotels and cruise lines won’t give you a full refund if you have to cancel.

Most hotels may impose a cancellation fee if you do so two weeks or more before your vacation; many travel companies may only offer a partial refund or partial credit towards a future voyage.

Several businesses won’t offer you any money back if you cancel within two weeks of your vacation.

Limits Beyond Your Credit Card:

If they offer cancellation/interruption coverage at all, some credit cards offer a limited amount of protection, with annual caps and restrictions.

Though few credit cards offer coverage for the most expensive travel risks, such as healthcare fees or urgent airlifts, which travel insurance might cover.

Travel Insurance possible excluded coverage:

While there are numerous reasons to purchase travel insurance, it’s vital to be aware that some situations could not be covered.

Look for a plan that offers a preexisting condition waiver if you have a preexisting condition.

If you’re travelling to a region where there is political instability, find out what protections a policy offers in case you need to cancel due to issues there.

Some instances of tour operator defaults brought on by financial difficulties are covered by this insurance coverage. Before making your travel plans, find out how that is handled.

What is the price of travel insurance?

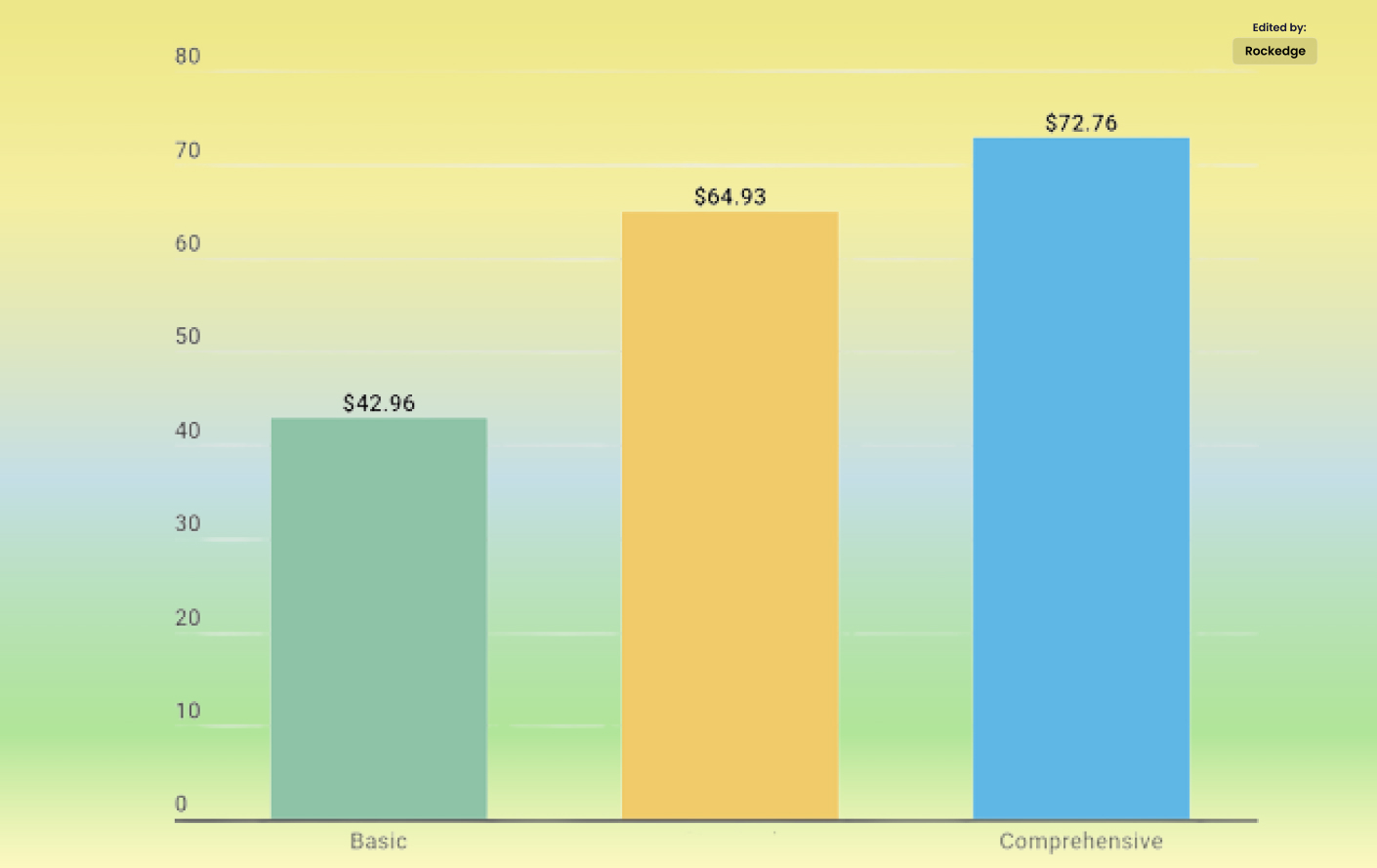

The cost of travel insurance is mostly determined by the trip’s cost and the age of the traveller.

According to Jonathan Harty, proprietor of a travel firm in Massachusetts, a 35-year-old may anticipate that an insurance will increase the cost of a trip by 3% to 5%, while a 60-year-old might spend around 10%.

Protecting your investment in a honeymoon or once-in-a-lifetime trip may be a minor price to pay.

Which type of travel insurance should you purchase?

Evaluate your potential cancellations before researching the insurance. Will a weather-related travel delay significantly alter your vacation?

Is it feasible that you’ll have to take a work-related trip in its place or that your school year will be extended? Do war crimes occur in the nation you’re visiting?

Are you concerned that the CDC may issue a travel advisory for where you plan to go on vacation?

These are all acceptable justifications for postponing a trip or needing insurance. However, not all types of travel’s insurance cover these issues.

Cancellation insurance for any cause:

If you have a hangnail and wish to cancel this coverage after purchasing it, feel free to do so. Usually, the insurance provider doesn’t require a justification.

They only require a cancellation within the stipulated window, usually at least 48 to 72 hours before your departure.

Detailed travel insurance:

When people think of trip insurance, this is typically the type of policy they picture.

The extensive coverage typically covers lost luggage, delays, cancellations due to illness or death, and some emergency medical expenses.

Just be sure you read the small print to understand what it covers.

Changing scope:

You have a certain amount of time to decide if the insurance meets your needs, and you can get a complete refund (perhaps less a small administrative cost), if you do so soon after purchasing it.

This gives you the opportunity to carefully read the coverage and confirm that it offers what you need.

Usually, such period lasts between 10 and 15 days

Epilogue:

It’s vital to comprehend fully what the policy covers and how claims are processed as much as possible.

Investigate insurance at the same time you make a costly travel reservation.

Some policies mandate that you get this insurance within a predetermined window of time following the payment of your original trip, typically between 10 and 30 days.

You can purchase Nationwide Travel Insurance up to the day before your departure.

Traveling should be a thrilling experience

Of course, it’s best to purchase travel insurance far enough in advance to allow for appropriate planning.

While cancellation and other issues can be stressful, you can eliminate the financial stress by insuring your vacation.