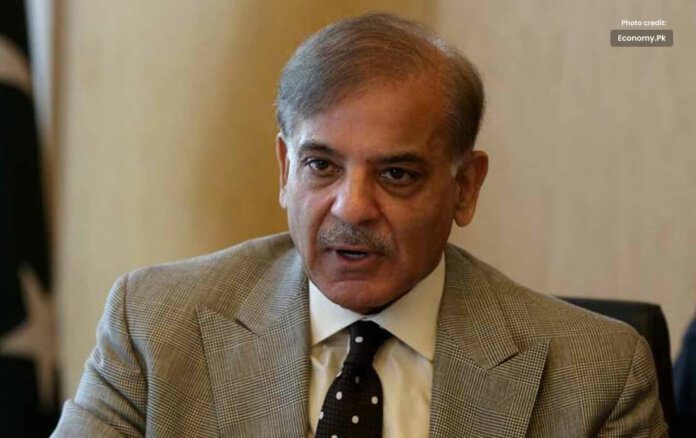

PM Shehbaz Sharif: $600 million loan from Exim Bank of China to forex.

Exim Bank of China transferred $600 million to Pakistan yesterday, increasing the country foreign exchange reserves, according to PM Shehbaz Sharif, who also noted that support from friendly nations is boosting economic indicators.

But he didn’t say anything about when this payment was due.

After the International Monetary Fund (IMF) authorized a $3 billion rescue package and transferred the first tranche of $1.2 billion under a nine-month stand-by agreement, the nation is displaying signs of economic stability.

Pakistan received $2 billion from Saudi Arabia and $1 billion from the United Arab Emirates earlier this month after both countries were comforted by the deal Islamabad and the IMF reached at the end of June. Pakistan had previously been on the verge of a sovereign debt default.

The State Bank of Pakistan said last Thursday that Pakistan foreign exchange reserves held by the central bank improved marginally by $61 million to stand at $4.524 billion in the week ended July 7.

Projections from the IMF

According to a statement from the IMF, the rescue plan would concentrate on implementing a monetary policy that was sufficiently tight in order to reduce pricing pressures in the 220 million-person South Asian nation.

The IMF projects that inflation will be on average 25.9% in fiscal year 2024, but that it will moderate significantly to roughly 16% by the end of that time.

For fiscal 2024, the government expects inflation to be 21% with the main policy rate at 22%.

Going forward, it is necessary to maintain a strict, proactive, and data-driven monetary policy, according to the IMF statement.

With only enough reserves in the central bank to fund only a month’s worth of restricted imports, Pakistan’s struggling economy is currently experiencing a severe balance of payments crisis. In fiscal 2024, the IMF forecasts that it will have an import cover of 1.4 months.

Deal with the IMF that provided Pakistan with a lifeline when it was on the edge of default was finally negotiated after eight months of challenging discussions about fiscal restraint.

“A market-determined exchange rate is also critical to absorbing external shocks, reducing external imbalances, and restoring growth, competitiveness, and buffers,” the IMF stated.